An instrument relating to the sale and purchase of retail debenture and retail sukuk as approved by the Securities Commission under the Capital Markets and Services Act 2007 Act 671 are exempted from stamp duty. Education fees Self Other than a degree at masters or doctorate level - Course of study in law accounting islamic financing technical vocational industrial scientific or technology.

Lhdn Updates Stamp Duty Exemptions

Customs is an authority or agency in a country responsible for collecting tariffs and for controlling the flow of goods including animals transports personal effects and hazardous items into and out of a country.

. Real Property Gains Tax RPGT Rates. Changes were made in 1963. Purchase of basic supporting equipment for disabled self spouse child or parent.

IRBM Stamp Duty Counter Operating Hours. You also need to make sure you know about two additional fees that come with the renting process the stamp duty fees and administration charges for a Tenancy Agreement. Value-added tax VAT Supplies of goods and services which are deemed to take place in Luxembourg are subject to VAT at the standard rate of 17 lowest standard VAT rate in the European Union or on certain transactions at 14 eg.

Stamp Duty Exemption Order. Traditionally customs has been considered as the fiscal subject that charges customs duties ie. In 1963 the rate of the UK Stamp Duty was 2 subsequently fluctuating between 1 and 2 until a process of its gradual reduction started in 1984 when the rate was halved.

Generally it is easy to calculate stamp duty according to the rates provided by the Indian Stamp Act or the State. Delay in payment of stamp duty can make the individual liable to pay a fine ranging from 2 to 200 of the total payable amount. This exemption order applies to a retail investor who is an individual for instruments executed on or after 1 Oct 2012 and not.

Bantuan Khas Kerajaan. IRBM Revenue Service Centre Operating Hours. Tariffs and other taxes on import and export.

Stamp duty was introduced as an ad valorem tax on share purchases in 1808 preceding by over 150 years the Tobin tax on currency transactions. Supply of gas or electricity or 3 eg. Certain wines advertising pamphlets management and safekeeping of securities 8 eg.

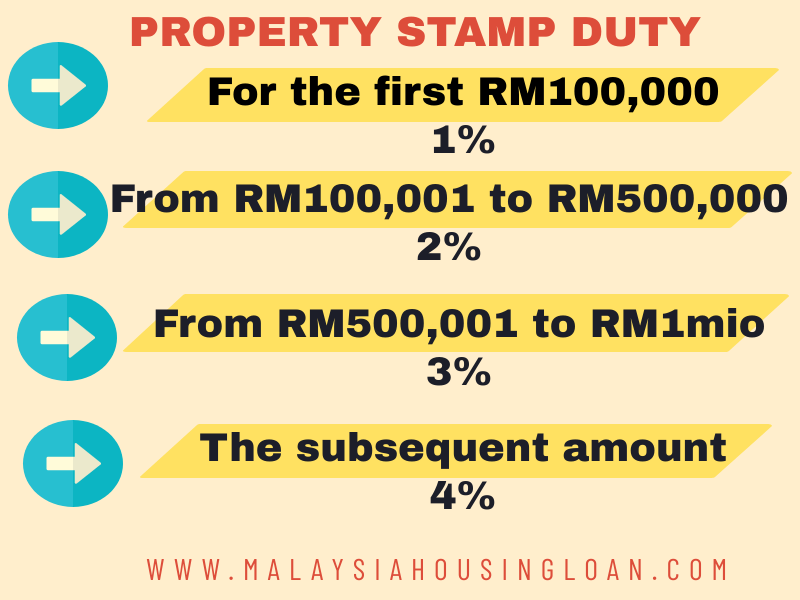

The stamp duty is to be made by the purchaser or buyer and not the seller. PropertyGuru Tip The stamping is to make the Tenancy Agreement legal and admissible in court and is done by the Inland Revenue Board of Malaysia LHDN.

Exemption For Stamp Duty 2020 Malaysia Housing Loan

Housing Development Updates Exemption Orders For Stamp Duty Chee Hoe Associates

Stamp Duty Exemption When Buying Subsale Property For First Time Home Buyer Kopiandproperty Com

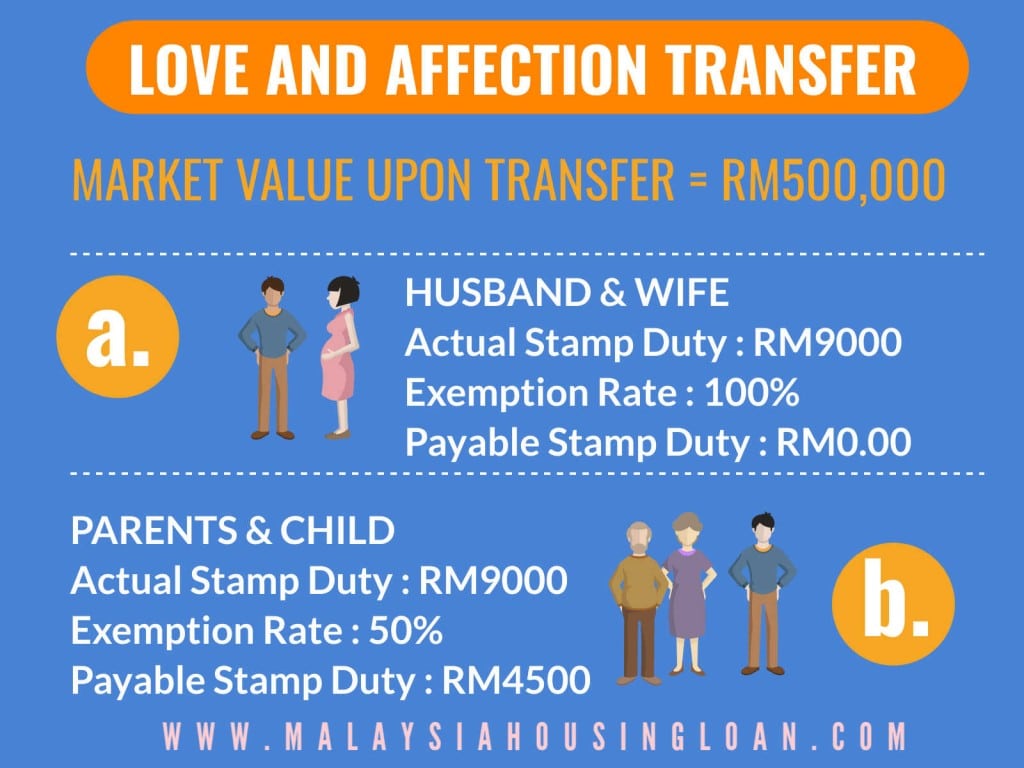

Love And Affection Transfer Malaysia 2022 Malaysia Housing Loan

Buying A House Here S 2022 Stamp Duty Charges Other Costs Involved

Covid 19 Real Estate Legal Updates The Malaysian Government Introduces Special Measures To Revitalise Real Estate Market Azmi Associates

Stamp Duty Exemption 2021 Nov 30 2021 Johor Bahru Jb Malaysia Taman Molek Service Thk Management Advisory Sdn Bhd

2020 Stamp Duty Exemptions News Articles By Hhq Law Firm In Kl Malaysia

Exemption For Stamp Duty 2020 Malaysia Housing Loan

Exemption For Stamp Duty 2020 Malaysia Housing Loan

Exemption For Stamp Duty 2020 Malaysia Housing Loan

Budget 2021 Stamp Duty Exemption 2021 2025 And Other Benefits Malaysia Housing Loan

Hoc Program 2020 Marcus Keoh Mk Real Estate Facebook

Stamp Duty Exemption For House Buyers Infographics Propertyguru Com My

First Time Home Buyer Entitlements Privileges And Benefits Propsocial